Services

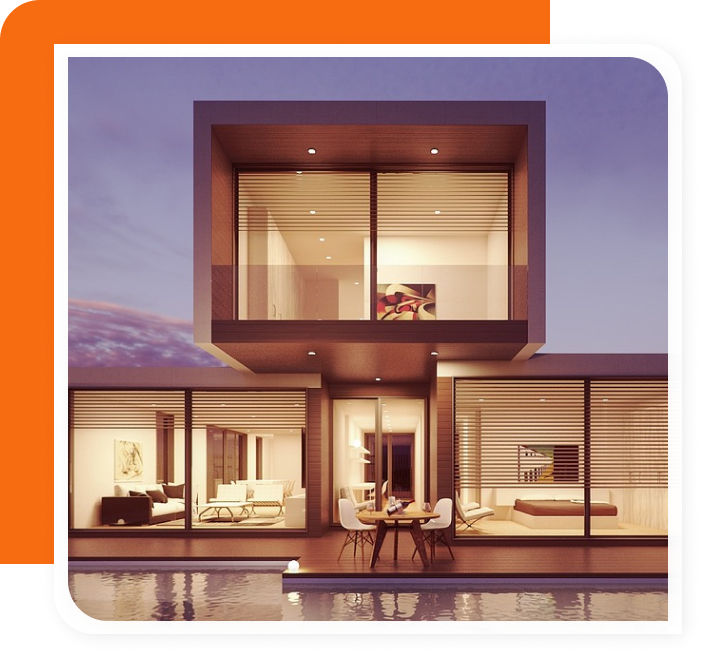

The Importance of Location in Real Estate

When it comes to buying or investing in real estate, one of the most crucial factors to consider is location. The location of a property can significantly impact its value, rental potential, and overall desirability.A prime location with amenities such as schools, shopping centers, parks, and good transportation links tends to attract more buyers or tenants. Additionally, properties in desirable neighborhoods often experience higher appreciation rates over time.

About Our Company

At our investment advisory company, we are driven by a passion for helping individuals achieve their financial goals through informed and strategic investing. With years of experience and a team of seasoned professionals, we have established ourselves as a trusted partner in guiding our clients towards financial success.

Services we provide

Online Coaching

Unlock your real estate potential with our premium online coaching service. Whether you're a beginner or an experienced investor, our expert coaches are here to guide you every step of the way.

Internship opportunity

Embark on a transformative journey with our prestigious internship opportunity. Gain hands-on experience, build valuable skills, and accelerate your career in a dynamic and supportive environment.

Certificate

Elevate your real estate expertise with our recognized certificate program. Enhance your skills and knowledge in key areas such as property valuation, investment analysis, and market trends.

Real Estate Investment Advisory

Maximize your real estate investments with our expert advisory services. Our team of experienced professionals will provide personalized guidance tailored to your investment goals.

Relocation Assistance

Simplify your real estate relocation with our comprehensive assistance services. Whether you're moving across town or to a new city, our dedicated team will guide you through the entire process.

Market Analysis and Research

Stay ahead of the real estate market trends with our in-depth analysis and research reports, empowering you to make informed decisions and seize opportunities.

Tips for First-Time Homebuyers

Determine your budget: Assess your finances and set a realistic budget for your home purchase, including the down payment, closing costs, and ongoing expenses.

Get pre-approved for a mortgage: Before starting your home search, obtain a pre-approval from a reputable lender. This will give you a clear idea of how much you can afford and strengthen your position when making an offer.

Work with a real estate agent: Engage a professional real estate agent who understands your needs and has expertise in the local market. They can guide you through the process, negotiate on your behalf, and help you find the right property.

Our Team

Our team combines expertise, passion, and dedication to provide exceptional real estate investment solutions

Thanks for amet consectetur adipisicing elit. Mollitia, quis! Iste debitis id nulla, nesciunt minus enim, ea sed, doloremque inventore tenetur magnam minima fugit sint consequatur repudiandae! Numquam, perspiciatis.

Raba Ruthot

Thanks for amet consectetur adipisicing elit. Mollitia, quis! Iste debitis id nulla, nesciunt minus enim, ea sed, doloremque inventore tenetur magnam minima fugit sint consequatur repudiandae! Numquam, perspiciatis.

Raba Ruthot

Your right to know (FAQ's)

How much can I afford to spend on a home?

Your affordability depends on various factors, including your income, savings, credit score, and existing debts. A general rule of thumb is that your monthly mortgage payment should not exceed 28% to 30% of your gross monthly income. However, it's recommended to consult with a mortgage lender to get pre-approved and determine an accurate budget.

What is the difference between pre-qualification and pre-approval?

Pre-qualification is an initial assessment of your financial situation based on self-reported information. It gives you a general idea of how much you might be able to borrow. Pre-approval, on the other hand, involves a comprehensive evaluation by a lender who verifies your financial information, credit history, and income. Pre-approval provides a more accurate estimate of how much you can borrow and strengthens your position as a buyer.

How long does it take to buy a home?

The timeline for buying a home can vary. On average, it takes around 30 to 45 days from the time you submit an offer to the closing of the transaction. However, factors such as the complexity of the transaction, market conditions, and mortgage approval process can affect the duration. It's advisable to work closely with your real estate agent and lender to get a better estimate based on your specific circumstances.

What is the role of a real estate agent?

A real estate agent is a licensed professional who assists buyers or sellers in real estate transactions. They have expertise in the local market, access to property listings, and knowledge of the buying or selling process. Agents help clients navigate the market, find suitable properties, negotiate offers, handle paperwork, and provide guidance throughout the transaction.

What are closing costs?

Closing costs are the fees and expenses associated with the purchase or sale of a property. They typically include fees for services such as property appraisal, home inspection, title search, attorney fees, lender fees, and prepaid expenses like property taxes and homeowners insurance. Closing costs are usually paid by both the buyer and the seller, and they can range from 2% to 5% of the home's purchase price.

Is renting or buying a home a better option?

Renting or buying depends on various factors, such as your financial situation, lifestyle preferences, and long-term plans. Renting provides flexibility and fewer responsibilities, but you don't build equity. Buying a home allows you to build equity, enjoy potential appreciation, and have more control over your living space. It's essential to assess your circumstances and consider factors like the local housing market, rent prices, and your future goals to make an informed decision.

Click to edit heading

What our investors says

Sarah Johnson

Working with this Realty has been a game-changer for me. Their expert team led by John Thompson provided valuable insights and guidance throughout the entire buying process. I found my dream home within weeks and couldn't be happier. Highly recommend their services!

Michael Adams

I can't thank this Realty enough for their exceptional service. From listing my property to negotiating the sale, their team, led by Lisa Carter, went above and beyond. They delivered results and sold my property at a great price. Their professionalism and expertise are unparalleled!

Emily Brown

Kudos to the outstanding team at DEF Realty! With their help, I invested in a lucrative rental property that generates steady passive income. James Anderson's expertise and personalized approach made the whole experience smooth and stress-free.

Latest Blogs

Get In Touch